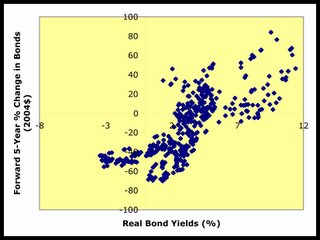

My interest was to see what the historical record had to say about our historically low real bond yields, hovering just under 2% (real yields are yields minus inflation). If you look at the forward 5-year change in bond prices as a function of real bond yields, you notice at that present levels, bonds have been a good way to lose money.

This is hardly surprising - low yields indicate high demand, and any value investor will tell you that when there is too much exuberance in the market, that asset will likely fall in price when investors realize the unsustainability in price.

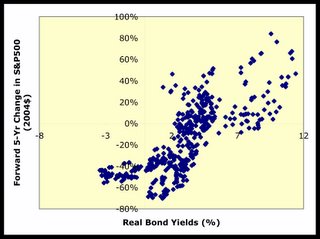

So stocks are the way to go, right? After all, the fundamental principle of diversification is that stocks and bonds are inversely correlated. Well, not quite. If you look at the historical record, at present real bond yields, stocks have suffered quite badly in the ensuing years.

My first thought were that historical low real bond yields must have been associated with inflationary periods which killed businesses with high raw material costs. Unfortunately, this does not completely solve the puzzle, as plotting the data in terms of unadjusted (rather than real) prices shows similar trends.

Why this happens is a mystery to me, one I'd like to understand. If there's someone with an economics background or just a better understanding of these phenomena, please cue me in.

If this reasoning is correct, that makes the case for inflation-protected securities or CDs yielding above inflation. At last count, I-bonds were yielding (real) something like 1.6% (I think), while most CDs were closer to 0.75%. While an 4-8% real return over a 5-year period hardly seems appealing, the record suggests this may be better than rather significant losses in equities or fixed income assets.

OK, now for the less interesting (to many) details of assumptions and the weakness of my arguments.

(1) I assume that this limited (42 years) data set is sufficient.

(2) I assume that multiple factors are priced into real bond yields. While I did consider inflation above, the economy is a complex and nonlinear system, and it is questionable if real bond yields reflect the nonlinearities appropriately.

(3) I do not consider international investing. Correlations between international economies and the US are something to look at - I would argue that much of the Asia-Pacific economies are tied to the US, and a slowdown in the US economy would wreak havoc on these economies.

No comments:

Post a Comment