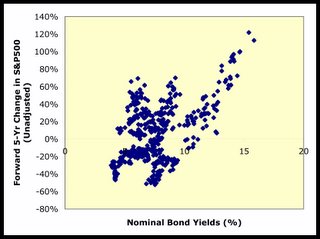

First note that at high nominal yields, there is a direct correlation between those yields and ensuing performance. This would suggest the early phases of stock bull markets, where either inflation has investors fleeing bonds, or hype has them running to stocks (a la 1990s). But when we get to lower nominal bond yields, there appears little correlation between these yields and ensuing stock performance.

So what about my conclusions in the previous post on the need for capital preservation? Let's look at the data since 1981, when the era of hyperinflation ended.

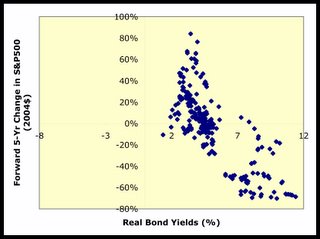

As we can see, this graph suggests that at present real bond yields, there is a lot of bullishness about bonds, meaning stocks may actually outperform bonds (delusion of crowds phenomenon). This woud be especially true if we believe concerns about inflation are overplayed.

Certainly there are many assumptions in this analysis, and this screw-up emphasizes why you should not take any one person's ideas too seriously!

No comments:

Post a Comment