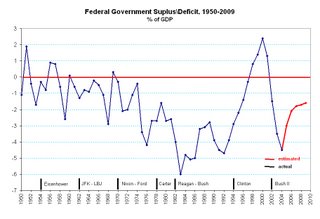

First the idea that Reagan somehow proved deficits don't matter. I'd love to see evidence that this was the case. The reality is that we have had a serious deficit crisis building for the last several decades, one that was temporarily ameliorated by the booming '90s (see the figure, taken from this page at K-State)

The red line's the Federal government's projects for the deficit. Keep in mind they are required to cut the budget in half within the next 5 years, so I'd take their projections with more than a grain of salt. The question is will tax receipts be able to reduce deficits? Given the multitude of asset bubbles we have at present, it appears unlikely that we will see even constant, let alone booming, receipts without a sharp increase in tax rates. We might, but it hardly is a given. Prudence then requires we focus on the spending side.

But of course, all this leads back to politicians. How many pols win elections talking about deficits as opposed to their favorite pet projects, be it war, protection of entitlement spending or what have you? And so we can continue to see growing deficits and more macroeconomic concern.

No comments:

Post a Comment