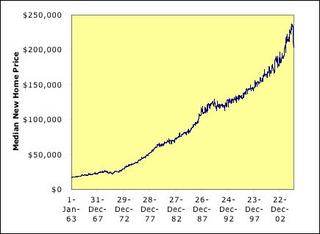

The first one is what you are likely to see any time someone convinces you that the road to wealth is by buying their newsletter, investing in the stock market or whatever. In this case, it's to show how rich you'd have been if you had invested in real estate.

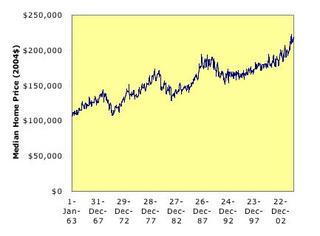

Wow, how can you argue with that, right? Well, turns out that little thing we rarely think about these days, inflation makes a big difference. Here are the same numbers in 2004 dollars.

Still good, but certainly doesn't look like the pathway to Mackena's gold! Well, then there is that little thing called risk. You only have to read the works of Benjamin Graham and William Bernstein to realize that the path to higher returns is often associated with higher risk (see, those newsletters promising to make you money never tell you how much you lost. The master investor Warren Buffer always said rule 1 of investing was - never lose money! Rule 2? Always pay attention to rule 1!!)

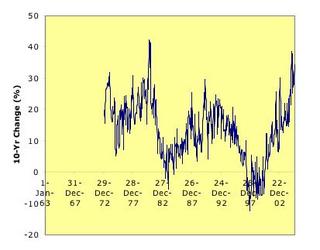

Looking at changes in new home prices over 5 years reveals something quite interesting - it bursts the myth that home prices can never go down. BTW, this is based on new home prices - you will have to include a discount for the house being 5-yrs old, and that discount actually increases when the market crashes.

Add in the fact that a house is highly leveraged and you could really lose your shirts. Planning on holding on to your home for a longer period does mitigate these risks somewhat. The figure below is the percentage change in value over 10 years.

My point is not to bash the act of buying a house. Heck, I sure hope I can do it someday. My mission is rather to educate, because I've encountered a shocking number of people who invest substantial sums of money without asking some rather basic questions about the risk or returns of their investment! I have heard people say that real estate is an investment, and yet not apply the same critical analysis to real estate markets as they would to the stock market.

2 comments:

hi. do you know about phil town's blog? he's a warren buffett-style investor. actually he calls his blog "the rule #1 blog" because he tells people to follow that rule and not lose. you might enjoy reading it.

oops i forgot the URL. it's:

http://www.philtown.typepad.com

enjoy!

Post a Comment